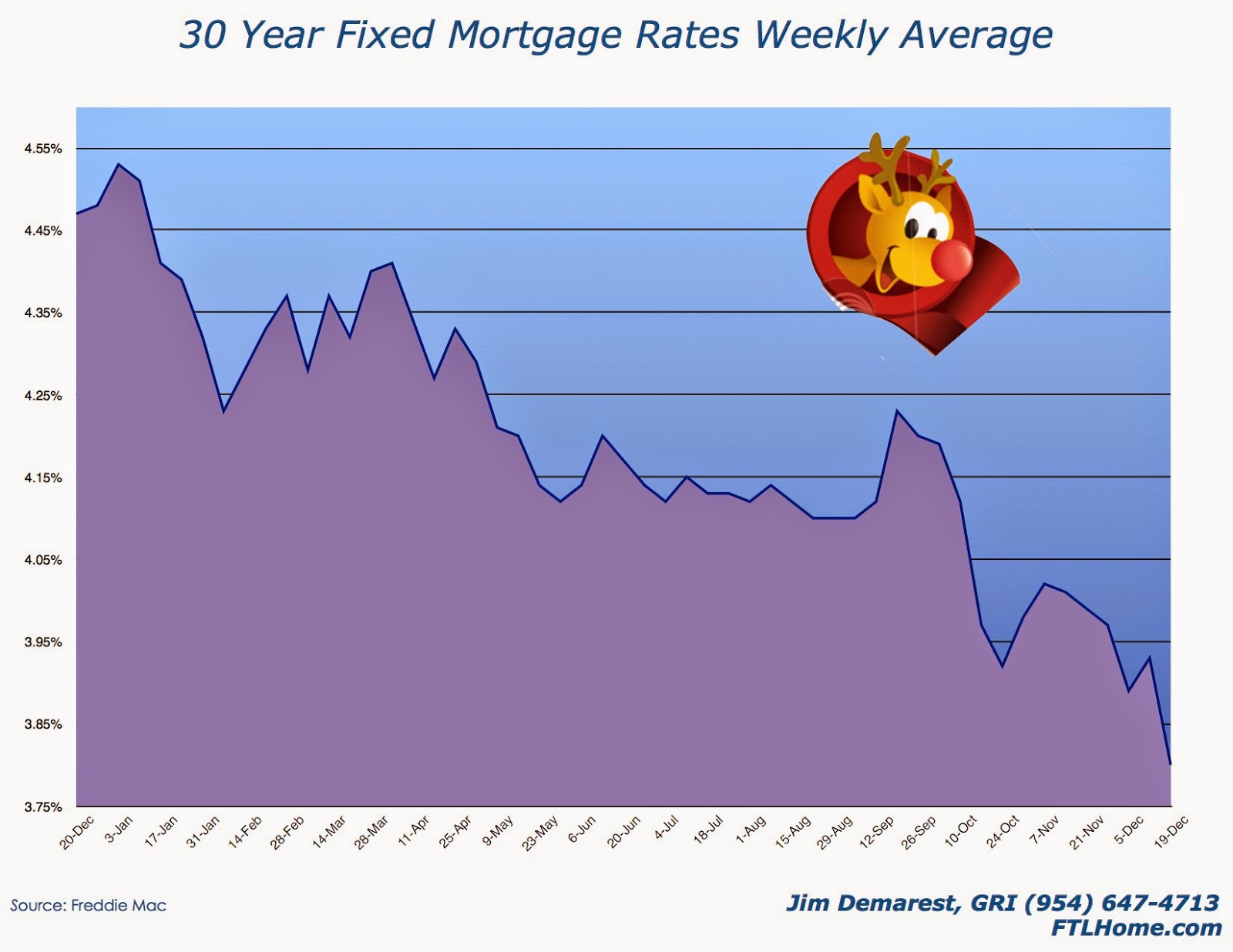

The national average mortgage rate is 3.80% this week for 30 year fixed-rate loans (the lowest rate of 2014)

; it was 3.93% last week. 15-year rate average is 3.09%. Buyers should always investigate the possibility of a 15-year loan. In some cases a few more dollars each month can translate to thousands saved over the life of a mortgage. Note that these are the National Average rates check with your lender for rates in Fort Lauderdale-or give me a call for a lender referral.

The national average mortgage rate is 3.93% this week for 30 year fixed-rate loans; it was 3.89% last week. 15-year rate average is 3.20%. Buyers should always investigate the possibility of a 15-year loan. In some cases a few more dollars each month can translate to thousands saved over the life of a mortgage. Note that these are the National Average rates check with your lender for rates in Fort Lauderdale-or give me a call for a lender referral.

The national average mortgage rate is 3.93% this week for 30 year fixed-rate loans; it was 3.89% last week. 15-year rate average is 3.20%. Buyers should always investigate the possibility of a 15-year loan. In some cases a few more dollars each month can translate to thousands saved over the life of a mortgage. Note that these are the National Average rates check with your lender for rates in Fort Lauderdale-or give me a call for a lender referral.

Slow growth in consumer spending is keeping inflation at bay but as the economy improves it will be necessary to raise rates. (the opinion of this charlatan economist). What this means to you is; it is unlikely rates will be any more favorable than they are right now. If you've been putting off refinancing or making a purchase, now is the time to make your move.

The national average mortgage rate is 3.89% this week for 30 year fixed-rate loans; it was 3.99% last week. 15-year rate average is 3.10%. Buyers should always investigate the possibility of a 15-year loan. In some cases a few more dollars each month can translate to thousands saved over the life of a mortgage. Note that these are the National Average rates check with your lender for rates in Fort Lauderdale-or give me a call for a lender referral.

Slow growth in consumer spending is

keeping inflation at bay but as the economy improves it will be necessary to raise rates. (the opinion of this charlatan economist). What this means to you is; it is unlikely rates will be any more favorable than they are right now. If you've been putting off refinancing or making a purchase, now is the time to make your move.