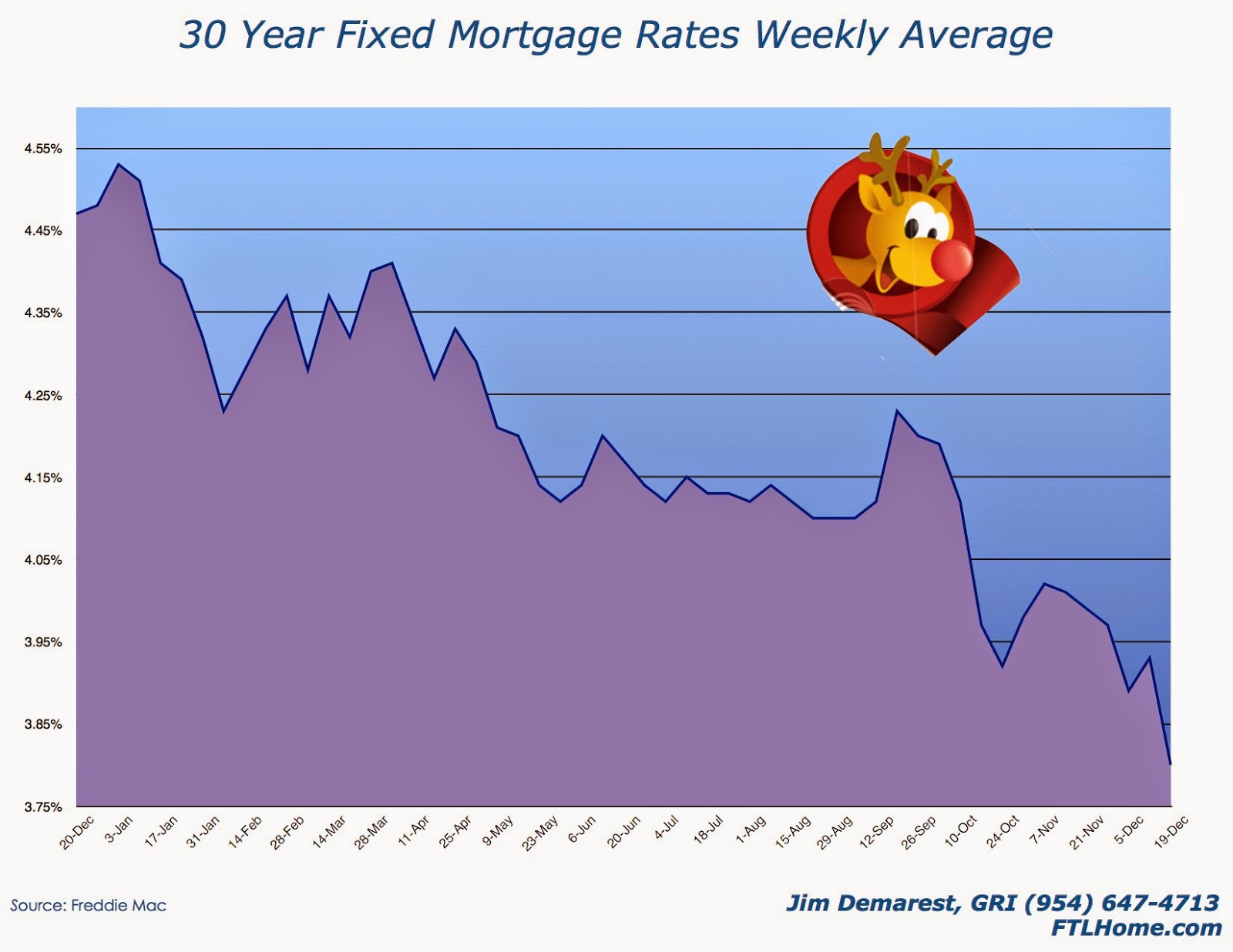

The national average mortgage rate is 3.80% this week for 30 year fixed-rate loans; it was 3.76% last week. 15-year rate average is 3.07%. Buyers should always investigate the possibility of a 15-year loan. In some cases a few more dollars each month can translate to thousands saved over the life of a mortgage. Note that these are the National Average rates check with your lender for rates in Fort Lauderdale-or give me a call for a lender referral.

The national average mortgage rate is 3.80% this week for 30 year fixed-rate loans; it was 3.76% last week. 15-year rate average is 3.07%. Buyers should always investigate the possibility of a 15-year loan. In some cases a few more dollars each month can translate to thousands saved over the life of a mortgage. Note that these are the National Average rates check with your lender for rates in Fort Lauderdale-or give me a call for a lender referral.Low rates make market-priced real estate more affordable. If you are on the fence to Sell or Buy...you should ACT NOW!